When it consists of dental health, one of the most not unusual questions human beings have is ready the price and insurance of numerous techniques. Snap-in dentures, also known as implant-supported dentures, are a well-known preference for those looking for to replace lacking enamel. But are they blanketed through coverage? Let’s dive into this trouble depend and discover all of the statistics.

What Are Snap-In Dentures?

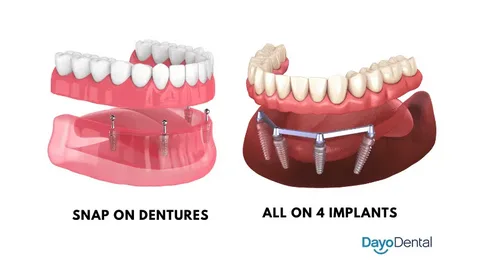

Snap-in dentures are a shape of denture that is anchored to the jawbone the usage of dental implants. Unlike conventional dentures, that might slip and slide, snap-in dentures are greater solid and cozy. They “snap” onto implants, supplying a extra natural enjoy and higher capability.

How Do Snap-In Dentures Work?

The technique of getting snap-in dentures includes numerous steps:

- Consultation and Planning: Your dentist will study your oral health and decide in case you are an excellent candidate for snap-in dentures.

- Implant Placement: Titanium posts are surgically positioned into your jawbone. These posts act as anchors for the dentures.

Three. Healing Period: It takes a few months for the implants to fuse with the jawbone.

Four. Denture Fitting: Once the implants are at ease, the dentures are snapped into location.

Benefits of Snap-In Dentures

Snap-in dentures offer severa blessings over traditional dentures:

- Stability: They are tons much less possibly to move round to your mouth.

- Comfort: They lessen gum infection and are greater relaxed to place on.

- Functionality: You can eat and communicate extra without problem.

- Appearance: They appearance extra like natural enamel.

Drawbacks of Snap-In Dentures

However, there are also some downsides to undergo in mind:

- Cost: They are more high priced than traditional dentures.

- Surgery: The approach consists of surgical remedy, which comes with risks.

- Maintenance: They require regular protection and occasional modifications.

Are Snap-In Dentures Covered by way of the usage of way of using Insurance?

The massive question is whether or not or now not or now not insurance will cowl the price of snap-in dentures. The answer is: it is based upon.

Factors Influencing Coverage

- Type of Insurance Plan: Different insurance plans provide extremely good tiers of coverage. Some plans can also moreover moreover cowl a part of the value, whilst others won’t cover it the least bit.

- Medical Necessity: If the method is deemed medically essential, there may be a higher hazard of coverage. For instance, in case you want dentures due to an twist of future or scientific scenario, your coverage might also cowl more of the fee.

Three. Cosmetic vs. Functional: Insurance organizations frequently differentiate amongst splendor and beneficial strategies. Snap-in dentures can be considered beauty, that would have an impact on insurance.

Typical Coverage

Most dental coverage plans cover dentures at spherical 50% of the cost³. However, this can range drastically based totally at the specifics of your plan. It’s critical to check together together with your coverage business enterprise to understand your coverage.

How to Maximize Your Insurance Benefits

Here are some tips to help you get the most from your insurance:

- Pre-Authorization: Get a pre-authorization from your coverage enterprise earlier than gift system the way. This will come up with a smooth idea of what is going to be blanketed.

- In-Network Providers: Use in-community carriers to lessen out-of-pocket prices.

- Flexible Spending Accounts (FSA): Consider using an FSA to cowl a number of the prices.

Conclusion

Snap-in dentures are a outstanding alternative for the ones seeking to decorate their dental health and exquisite of existence. While they arrive with a higher rate tag, the blessings frequently outweigh the prices. Understanding your coverage insurance and exploring all your options can assist make this investment extra a whole lot less highly-priced.

For extra amazing data, you can go to Humana or Healthline.

I desire this text has supplied you with all of the statistics you need approximately snap-in dentures and insurance insurance. If you’ve got any greater questions, enjoy loose to ask!

¹: Humana

²: Healthline

³: Investopedia