Reps and Warranties Insurance (RWI) is a specialized type of insurance policy designed to protect against losses arising from breaches of representations and warranties made in business transactions. This insurance is particularly popular in mergers and acquisitions (M&A) deals, providing a safety net for both buyers and sellers.

What is RWI Insurance?

RWI insurance covers the indemnification obligations of the seller or the buyer in an M&A transaction. Essentially, it steps in to cover financial losses if any of the representations and warranties made by the seller turn out to be false. This can include inaccuracies in financial statements, undisclosed liabilities, or other misrepresentations.

Why is RWI Insurance Important?

Risk Mitigation

One of the primary reasons companies opt for RWI insurance is to mitigate risk. In M&A transactions, the stakes are high, and any misrepresentation can lead to significant financial losses. RWI insurance provides a layer of protection, ensuring that both parties can proceed with confidence.

Facilitating Transactions

RWI insurance can also facilitate smoother transactions. By transferring the risk to an insurance company, buyers and sellers can negotiate more freely, knowing that potential issues are covered. This can lead to quicker deal closures and more favorable terms for both parties.

Key Features of RWI Insurance

Coverage Scope

RWI insurance typically covers a wide range of representations and warranties, including financial statements, tax matters, intellectual property, and compliance with laws. The specific coverage will depend on the policy and the nature of the transaction.

Policy Limits and Retentions

The policy limit is the maximum amount the insurer will pay for covered losses. Retention, similar to a deductible, is the amount the insured must pay out of pocket before the insurance kicks in. These terms are crucial in determining the overall protection provided by the policy.

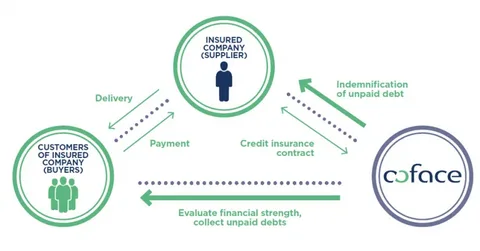

How RWI Insurance Works

Application Process

The application process for RWI insurance involves a thorough review of the transaction documents and due diligence reports. Insurers will assess the risk and determine the appropriate coverage and premium.

Claims Process

In the event of a breach, the insured party must notify the insurer and provide evidence of the loss. The insurer will then investigate the claim and determine the payout based on the policy terms.

Benefits of RWI Insurance

For Buyers

- Protection Against Unknown Risks: Buyers can protect themselves against unknown risks that may arise after the transaction is completed.

- Enhanced Negotiation Power: With RWI insurance, buyers can negotiate better terms, knowing they have a safety net in place.

For Sellers

- Clean Exit: Sellers can achieve a cleaner exit from the transaction, with fewer post-closing liabilities.

- Attractive to Buyers: Offering RWI insurance can make the deal more attractive to potential buyers, facilitating a quicker sale.

Challenges and Considerations

Cost

RWI insurance can be expensive, with premiums typically ranging from 2% to 4% of the policy limit. Companies must weigh the cost against the potential benefits and risks.

Exclusions

Not all risks are covered by RWI insurance. Common exclusions include known issues, forward-looking statements, and certain types of liabilities. It’s essential to understand these exclusions when purchasing a policy.

Current Trends in RWI Insurance

Increased Adoption

The use of RWI insurance has been steadily increasing, particularly in the middle market. More companies are recognizing the value of this insurance in facilitating transactions and protecting against risks.

Broader Coverage

Insurers are continually expanding the scope of coverage offered by RWI insurance. This includes more comprehensive protection for various types of representations and warranties.

Conclusion

RWI insurance is a valuable tool in the world of mergers and acquisitions, providing protection and facilitating smoother transactions. By understanding the key features, benefits, and challenges of RWI insurance, companies can make informed decisions and mitigate risks effectively.

For more detailed information on RWI insurance, you can visit Zekul.net, Cixiq.net, Ucejat.net, Ijofed.net, and Jhanak.sbs.

Contact Information

For further inquiries or to get a quote, you can contact the following:

- Zekul Insurance Services: +1-800-123-4567

- Cixiq Insurance Brokers: +1-800-987-6543

- Ucejat Insurance Solutions: +1-800-456-7890

Feel free to reach out to these providers for personalized assistance and detailed plans tailored to your needs.

Most Vist Information Zekul.net Cixiq.net Ucejat.net Ijofed.net Jhanak.sbs