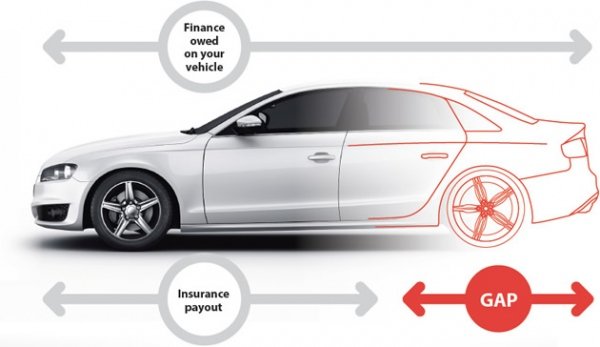

When you drive a new car off the lot, its value starts to depreciate almost immediately. This can be a problem if your car is totaled or stolen, as your standard auto insurance might not cover the full amount you owe on your loan or lease. This is where Safe Guard Gap Insurance comes into play. It covers the “gap” between what your car is worth and what you still owe, ensuring you’re not left paying for a car you no longer have.

What is Gap Insurance?

Gap insurance, or Guaranteed Asset Protection insurance, is designed to cover the difference between the actual cash value of your vehicle and the balance still owed on your financing. This type of insurance is particularly useful for those who have financed a new car or have a lease agreement.

Why Do You Need Safe Guard Gap Insurance?

Protection Against Depreciation

Cars depreciate quickly, and if your vehicle is totaled or stolen, the payout from your standard insurance might not be enough to cover the remaining balance on your loan. Safe Guard Gap Insurance ensures that you are not left with a hefty bill for a car you no longer have.

Peace of Mind

Knowing that you are covered in the event of a total loss can provide significant peace of mind. You won’t have to worry about being financially burdened if the unexpected happens.

How Does Safe Guard Gap Insurance Work?

Coverage Details

When you purchase Safe Guard Gap Insurance, it will cover the difference between your car’s actual cash value and the amount you owe on your loan or lease. For example, if your car is worth $20,000 but you owe $25,000, gap insurance will cover the $5,000 gap.

Claim Process

In the event of a total loss, you will need to file a claim with both your standard auto insurance and your gap insurance provider. Your auto insurance will pay out the actual cash value of the car, and your gap insurance will cover the remaining balance.

Who Should Consider Safe Guard Gap Insurance?

New Car Buyers

If you are buying a new car, especially one that depreciates quickly, gap insurance is a wise investment. It can save you from financial hardship if your car is totaled or stolen shortly after purchase.

Leaseholders

Those who lease their vehicles should also consider gap insurance. Lease agreements often have high early termination fees, and gap insurance can help cover these costs if your car is totaled.

How to Purchase Safe Guard Gap Insurance

Through Your Dealer

Many car dealerships offer gap insurance at the time of purchase. While this can be convenient, it’s important to compare prices and coverage options to ensure you’re getting the best deal.

Through Your Insurance Provider

You can also purchase gap insurance through your auto insurance provider. This can often be more cost-effective and allows you to bundle your coverage with your existing policy.

Cost of Safe Guard Gap Insurance

Factors Affecting Cost

The cost of gap insurance can vary based on several factors, including the make and model of your car, your loan amount, and your insurance provider. On average, gap insurance can cost between $20 and $40 per year when added to your existing auto insurance policy.

Is It Worth the Cost?

For many drivers, the peace of mind and financial protection offered by gap insurance is well worth the cost. It’s a small price to pay to avoid potentially thousands of dollars in out-of-pocket expenses.

Common Misconceptions About Gap Insurance

It’s Only for New Cars

While gap insurance is most commonly associated with new cars, it can also be beneficial for used cars, especially if you have a high loan balance relative to the car’s value.

It’s Expensive

Gap insurance is often more affordable than people think. When added to your existing auto insurance policy, it can cost as little as a few dollars per month.

How to File a Gap Insurance Claim

Step-by-Step Process

- Report the Incident: Notify your auto insurance provider immediately if your car is totaled or stolen.

- File a Claim: Submit a claim with your auto insurance provider to receive the actual cash value of your car.

- Contact Your Gap Insurance Provider: Provide them with the necessary documentation to process your gap insurance claim.

- Receive Payment: Once your claim is approved, your gap insurance provider will cover the remaining balance on your loan or lease.

Frequently Asked Questions About Safe Guard Gap Insurance

Is Gap Insurance Mandatory?

No, gap insurance is not mandatory, but it is highly recommended for those who have financed a new car or have a lease agreement.

Can I Cancel Gap Insurance?

Yes, you can cancel your gap insurance at any time. However, it’s important to consider the potential financial risk before doing so.

Does Gap Insurance Cover Deductibles?

Some gap insurance policies may cover your deductible, but this varies by provider. Be sure to check the terms of your policy.

Conclusion

Safe Guard Gap Insurance is a valuable tool for protecting yourself against the financial impact of a total loss. Whether you’re buying a new car or leasing a vehicle, gap insurance can provide peace of mind and financial security. By understanding how gap insurance works and who should consider it, you can make an informed decision about whether it’s right for you.

For more detailed information, you can visit websites like Zekul.net, Cixiq.net, Ucejat.net, Ijofed.net, and Jhanak.sbs.

I hope this article helps you understand the importance and benefits of Safe Guard Gap Insurance. If you have any further questions or need more details, feel free to ask!

Most Vist Information Zekul.net Cixiq.net Ucejat.net Ijofed.net Jhanak.sbs