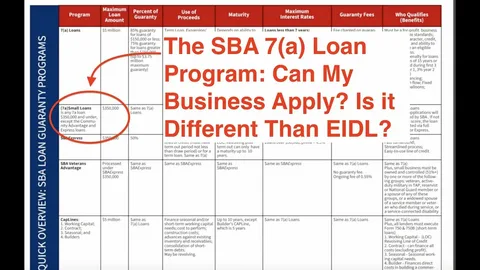

The SBA 7(a) Loan Program is one of the most popular loan options for small businesses in the United States. It offers flexible terms and a variety of uses, making it an ideal choice for entrepreneurs looking to start or expand their businesses.

- Loan Amounts: Up to $5 million

- Interest Rates: Typically between 5.5% to 8%

- Repayment Terms: Up to 25 years for real estate, 10 years for equipment

For more detailed information, visit the SBA Official Website.

Importance of Life Insurance for SBA 7(a) Loans

Life insurance plays a critical role in the SBA 7(a) loan process. It acts as a safety net for lenders, ensuring that loans are repaid in the event of the borrower’s untimely death.

Key Benefits:

- Provides financial security for the business

- Protects the interests of lenders

- Can be a requirement for loan approval

Types of Life Insurance Policies Accepted

When applying for an SBA 7(a) loan, certain types of life insurance are typically accepted:

| Type of Policy | Description |

|---|---|

| Term Life Insurance | Provides coverage for a specific period. |

| Whole Life Insurance | Offers coverage for the insured’s lifetime. |

| Universal Life Insurance | Flexible premium and coverage options. |

These policies help ensure that the loan amount can be repaid, providing peace of mind to both borrowers and lenders.

Determining the Coverage Amount

Determining the right coverage amount for your life insurance policy is crucial. Here are some factors to consider:

- Outstanding Loan Amount: Ensure the policy covers the full loan amount.

- Business Value: Consider the total value of your business.

- Future Financial Obligations: Factor in any additional debts or responsibilities.

Steps to Obtain Life Insurance for SBA 7(a) Loans

- Assess Your Needs: Analyze your business and personal financial situation.

- Consult with a Professional: Speak to an insurance agent or financial advisor.

- Choose the Right Policy: Select a policy that meets your needs and complies with SBA requirements.

- Submit Documentation: Provide necessary documentation to your lender.

Common Challenges and Solutions

Navigating the life insurance aspect of SBA 7(a) loans can present challenges. Here are some common issues and their solutions:

| Challenge | Solution |

|---|---|

| High Premium Costs | Shop around for the best rates. |

| Lengthy Approval Processes | Prepare all documentation in advance. |

| Policy Denials | Ensure compliance with lender requirements. |

Cost Considerations for Life Insurance

The cost of life insurance can vary significantly based on several factors:

- Age and Health: Younger, healthier individuals typically pay lower premiums.

- Type of Policy: Term policies are usually cheaper than whole life policies.

- Coverage Amount: Higher coverage amounts lead to higher premiums.

It’s essential to compare quotes from multiple insurers to find the best deal.

Role of Insurance Agents and Brokers

Insurance agents and brokers can simplify the process of obtaining life insurance for your SBA 7(a) loan. They can:

- Provide expert advice on policy selection

- Help navigate the application process

- Ensure compliance with SBA requirements

Quote:

“An insurance agent is not just a salesperson; they are your partner in safeguarding your business.” – Industry Expert

Maintaining and Updating Your Policy

Once you’ve secured a life insurance policy, it’s important to maintain and update it regularly. Consider the following:

- Review Annually: Assess your coverage needs every year.

- Update After Major Life Events: Adjust your policy after significant changes, such as business expansion or personal changes.

Legal and Compliance Aspects

Understanding the legal and compliance aspects of life insurance in relation to SBA 7(a) loans is essential. Key points include:

- Policy Assignment: Lenders may require the policy to be assigned to them.

- Disclosure Requirements: Ensure full disclosure of all relevant information during the application process.

Case Studies and Real-World Examples

Example 1: Successful Loan Acquisition

A small tech start-up secured a $300,000 SBA 7(a) loan by providing a term life insurance policy that covered the total loan amount. This not only reassured lenders but also enabled the business to capitalize on growth opportunities.

Example 2: Challenges Faced

A restaurant owner faced challenges in obtaining a loan due to insufficient life insurance coverage. After consulting with an insurance agent, they adjusted their policy, leading to successful loan approval.

In conclusion, understanding the interplay between life insurance and the SBA 7(a) loan program is vital for small business owners. By securing the right life insurance policy, you can protect your business, enhance your loan eligibility, and ensure peace of mind for all parties involved.